Botswana’s banking sector expanded by 7.7% in 2024, reaching total assets of $10.5bn, underscoring its resilience amid sluggish GDP growth and challenges in diamond exports.

According to the Bank of Botswana’s 2024 Banking Supervision. Annual Report, customer deposits climbed 3% to $7.8bn (P107.3bn), while gross loans and advances grew 6.5% to $6.3bn (P87.1bn), reflecting continued financial intermediation despite tight liquidity.

The report noted that capital adequacy ratios remained comfortably above statutory requirements, while non-performing loans (NPLs) decreased to 3.4% from 3.7% in 2023, indicating an improvement in asset quality.

“The banking system remained adequately capitalised, profitable, and liquid, with risk indicators improving over the review period,” the report stated.

Digital transformation and expanding access

Digital banking continues to transform Botswana’s financial landscape, with over 27,000 point-of-sale terminals now operating across the country. Electronic funds transfer (EFT) transactions surged by 10.9% to $24.5 billion (P333.6 billion), underscoring the rapid digital adoption across the economy.

Banks also increased hiring, with employment in the sector rising 3.9% to 5,293 people as institutions invested in digital infrastructure and enhanced customer experience.

The report credited the Banking Act 2023 for granting the central bank greater supervisory powers over microfinance institutions and savings cooperatives, thereby improving consumer protection and access to development finance.

Rapid expansion was also observed in statutory banks, whose collective assets grew 44.6% to $ 490 million (P6.7 billion), driven by a renewed focus on development lending.

Johannesburg-based financial analyst Jaco Smith told Allen Dreyfus that the results demonstrate “a rare balance between caution and confidence.”

“Botswana’s banks have managed to grow without taking on excessive risk. The moderation in loan growth and stronger capital positions show a sector focused on sustainability rather than short-term gains — a quality investors value in volatile times,” he said.

A safe bet in a volatile region

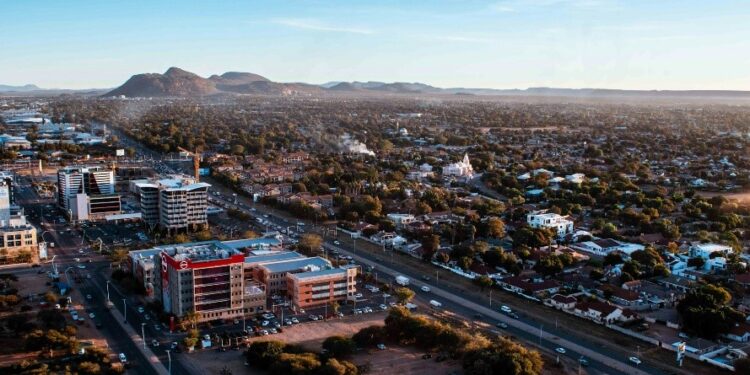

For international investors, Botswana’s banking sector remains one of the most stable in Africa. Analysts say the combination of strong governance, a proactive digital strategy, and consistent profitability provides a haven of certainty in a region often characterised by volatility.

The outlook for 2025 appears stable, with expectations of broad-based economic recovery, disciplined monetary policy, and growing regional interest in Botswana’s financial market as a secure and predictable investment destination.