The artificial intelligence boom is expensive, prompting venture capital firms to raise enormous sums to keep up.

The latest to do so is Lightspeed Venture Partners, a Silicon Valley firm that has backed 165 A.I. companies.

On Monday, Lightspeed announced that it had raised more than $9 billion in funding, its largest haul to date. The firm has also reoriented itself around A.I. and traveled the world to find new sources of capital.

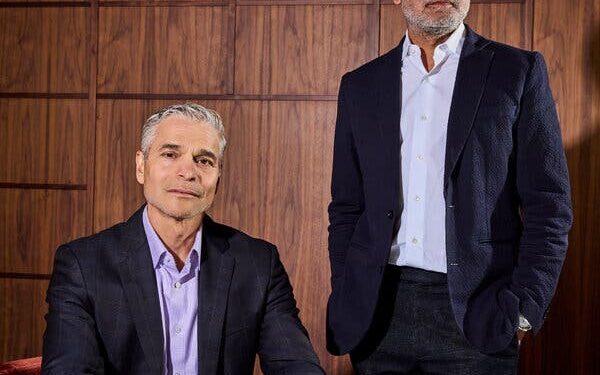

Ravi Mhatre, who co-founded Lightspeed 25 years ago, said the money matched the size of the opportunity. “The innovation economy today is mainstream,” he said. “It touches all parts of the economy and society.”

Other venture capital firms have also gone on fund-raising binges in the A.I. boom. Last year, Andreessen Horowitz collected $7.2 billion while General Catalyst amassed $8 billion. This year, the top 10 largest venture firms accounted for 43 percent of venture capital raised, according to PitchBook, which tracks the industry.

The sums are necessary to support the ambitions of venture-funded A.I. start-ups that have broken records with their funding and valuations. A.I. companies are spending outsized amounts to develop the technology and to power it with expensive chips and data centers.

Lightspeed’s new money is spread across six funds, with the largest chunk, $3.3 billion, dedicated to pouring more gas on the fire of its breakout hits. That includes large bets on Anthropic, the maker of the chatbot Claude; Elon Musk’s xAI, which makes the Grok chatbot; and Mistral, a French A.I. start-up.

Lightspeed said it realized that A.I. would upend its business after OpenAI debuted ChatGPT in 2022. The following spring, the firm’s top partners gathered to discuss the technology’s potential impact and concluded it was a paradigm shift.

Bejul Somaia, a Lightspeed partner, issued a firm-wide directive that everyone’s focus needed to be on AI He and Mr. Mhatre began sitting in on every AI pitch, and the firm changed its mix of partners, bringing on more people with AI expertise and cycling out others. The partners also teamed up five or six to a deal, avoiding the old-school venture model of individual rainmakers.

“It wasn’t, ‘Let’s go sink a bunch of money,’” Mr. Somaia said. “It was, ‘Gosh, this just needs to be front and center for all of us.’”

A moment of stress arrived early this year when DeepSeek, a Chinese start-up, revealed it had created a powerful AI model at a fraction of the cost of its well-funded U.S. competitors. Lightspeed had just agreed to invest $1 billion in Anthropic, the largest check it had ever written.

DeepSeek’s breakthrough, created using openly available technology, threatened to upend Anthropic’s leading position.

But Lightspeed had conviction that Anthropic was building a valuable business. In September, it helped lead an even bigger round of investment in the company, valuing it at $183 billion. This month, Anthropic announced it had hit $1 billion in annualized monthly revenue in just six months.

Valuations for many AI start-ups have largely skyrocketed. On paper, the value of Lightspeed’s portfolio has risen by $7 billion this year, Mr. Mhatre said.

Overall, fundraising for venture capital funds is down. A relative drought in initial public offerings means many institutional investors that back venture capital funds are still waiting to see returns on some of their older investments. Others are being more cautious given broader economic uncertainty.

However, some investors are seeking increased exposure to AI companies.

Michael Romano, Lightspeed’s chief business officer, who traveled the world to raise money for the firm, said he found investors in Korea, Japan, Australia, the Nordic countries, and Mexico that had never invested directly in venture capital funds before.

“They watched the movie from afar and saw how pervasive the technology has become,” he said. Investors increasingly want to invest directly in the start-ups alongside Lightspeed, he added.

Some investors were concerned about an AI bubble, but Mr. Mhatre told them he didn’t see it.

“A bubble, to us, is where the ratio of hype to substance is so far out of whack that you’re going to see some type of a snapback,” he said. He pointed to Anthropic’s revenue growth and other technological breakthroughs, like Waymo’s self-driving cars and AlphaFold, Google’s tool for predicting the structure of proteins.

Those give him confidence that the world is at a technological tipping point. “Right now, we’re in a period where the substance portion is high,” he said.